It’s important to start saving for your children’s higher education early. Unfortunately, many parents and students feel like saving for college cannot fit into their budget. Or they are not sure where to begin. In fact, one third of parents worry about paying for their children’s college education. Therefore, saving for college expenses is a concern for countless families.

Thankfully, with the right attitude and action, financing your kids’ higher education can be a breeze. You can save for college several ways including with a 529 account or Coverdell Education Savings Accounts (ESA). Regardless of what investment vehicle you choose, having a savings strategy is key.

4 Ways to Save for College

529 Savings Account

With a 529 plan, you can save for college and take advantage of tax deductions. Some states allow you to deduct your 529 contributions from your state taxes when you invest in your state’s 529 plan. However, you can invest in any state’s plan. Another perk is that you can also use 529 plans to save for your kid’s education from kindergarten to 12th grade too.

When you invest a 529 investment savings plan your money is invested in the stock market. It has the potential to grow from gains in the market. You use the money for educational expenses such as tuition, fees, books, supplies, equipment, computers, and sometimes room and board.

If your child decides not to go to college, you can use the money you saved for your education or for the education of another family member.

529 Prepaid Tuition Plan

A prepaid tuition plan allows you to pre-pay for all or some of in-state public college tuition. In some cases, if your child decides not to attend a public college, you can convert the money paid and apply it to a private or out-of-state college.

In addition, there is a Private College 529 Plan that you can invest in to pre-pay the tuition at private colleges. This plan is sponsored by more than 250 private colleges.

The prepaid tuition plan gets all the tax advantages of the 529 investment plan if you invest in your state’s plan.

Coverdell Education Savings Account

The Coverdell Education Savings Accounts (ESA) are similar to 529 plans. However, your annual contributions in an ESA are limited to $2,000 a year. Furthermore, if you make too much money you may be restricted from savings for college in an ESA. For example, couples earning more than $220,000 a year can not invest in an ESA.

Like other 529 plans, an ESA can be used for any educational expense in your child’s lifetime, including private school and academic tutoring. ESAs have more flexibility than the 529. The only catch is, money in ESAs must be used by the time your child is 30 or the account will be taxed.

Custodial Accounts

Custodial accounts, like a UTMA, allow adults to transfer gifts to minors. UTMA stands for the Uniform Transfers to Minors Act. When an adult sets up this account for a minor, the money contributed has the potential to earn interest. Custodial accounts are put into your child’s name and then they gain ownership of the money at age 18.

Some parents invest in a UTMA when they are not sure how much they can contribute to their child’s education. However, every little bit helps. Your child can use the money invested in a UTMA any way they like. So, if they don’t go to college or you save more than what college costs, your child can use the funds for other investments or expenses.

Start Saving for College

In addition to educating yourself on the latest college savings plans, you should always focus on best practices when it comes to budgeting and other personal finance basics.

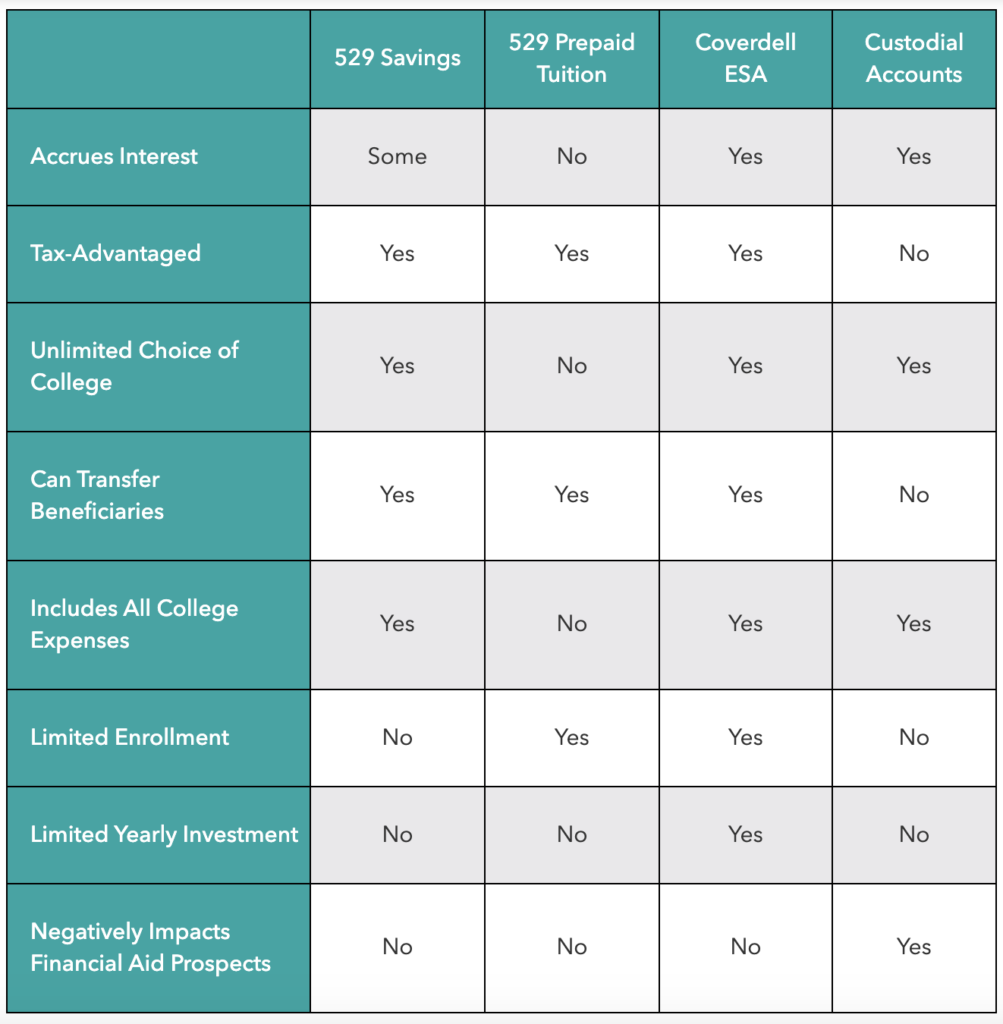

Weighing all of your financial options years in advance will set you up for success when it comes to helping your kids with their education. It’s crucial to stay financially grounded and plan ahead as much as possible. Check out the four key steps in a new parent’s financial journey. Also, use this handy chart below to compare some of the most popular education savings plans available today. Then check out the ultimate college savings guide for more insights.

How are you saving for college? I would love to hear your story or share it with The Purpose of Money community. Feel free to leave a comment below.